Report Overview

Ever wonder how much of hotel sales are driven by online travel agencies, exactly? And how is that different at branded versus independent properties? Skift Research’s latest report takes a deep dive into hotel distribution channels and the outlook for hoteliers to drive direct bookings in 2021 and beyond.

Built around a proprietary survey of hospitality operators, we are able to get a look into how many bookings each of nine different distribution channels deliver across the industry as well as the cost for each method.

Skift Research looks at both pre-pandemic baseline distribution channels, how the pandemic has shifted booking behavior and the prospects for driving direct bookings in 2021 at both branded and independent properties.

What You'll Learn From This Report

- The Pre-COVID state of hospitality distribution

- How third parties remain a crucial part of hotel distribution strategy

- Direct booking’s evolution from 2017 – 2019

- How brands and independents differ in their distribution mixes

- Distribution channels for Alternative Accommodations

- Analysis of costs and commissions for all distribution channels

- Where loyalty programs fit in the distribution mix

- The Impact of COVID-19 on hospitality distribution

- What the future distribution might look like

- Challenges and recommendations for driving direct bookings

Survey Details

Our latest look into hospitality booking channels is based off of a proprietary Skift Research survey of 132 individuals who are involved in the ownership or operations of a hotel, motel, or alternative accommodation and familiar with their company’s distribution strategy conducted in April of 2021. It is an update of our much cited 2017 Outlook on Hotel Direct Bookings.

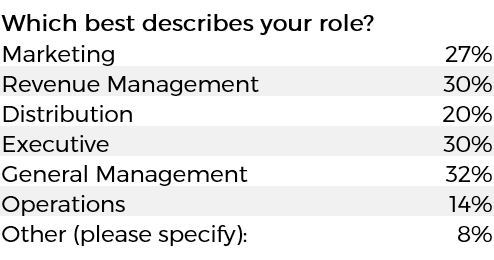

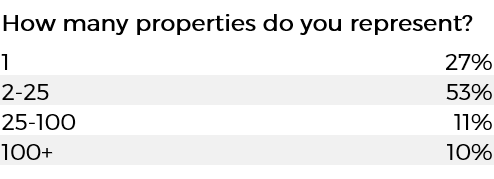

The respondents represent a broad mix of different accommodation businesses. Most of our respondents work at small-to-medium organisations with 2–25 properties (53%) with the second largest group operating a single property (27%). 44% are independent hoteliers, 37% branded hoteliers, and the remaining 19% represent alternative accommodations. In aggregate, our audience saw 77% of guests come from leisure, rather than business travel.

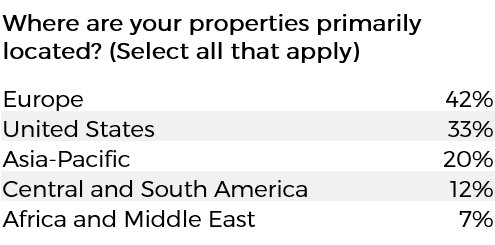

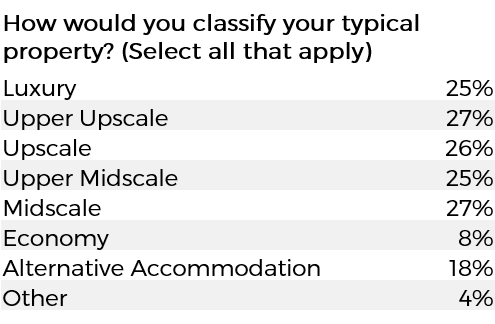

The two most common regions where survey respondents operated properties are in Europe (42% of responses) and the U.S. (33%). We had about equal representation among luxury, upper upscale, upscale, and upper midscale chain scales (approx 25% each); economy properties were somewhat underrepresented. Geography and chain scale data are not mutually exclusive and don’t sum to 100% as hospitality groups often operate across multiple regions and scales.

For more complete information on our survey audience, detailed respondent demographics are available as an appendix.

The Pre-COVID State of Hospitality Distribution

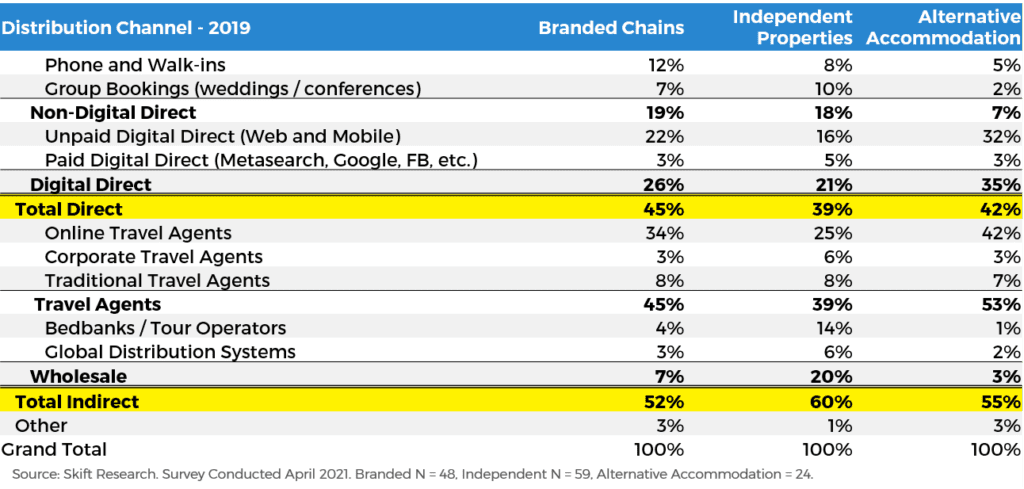

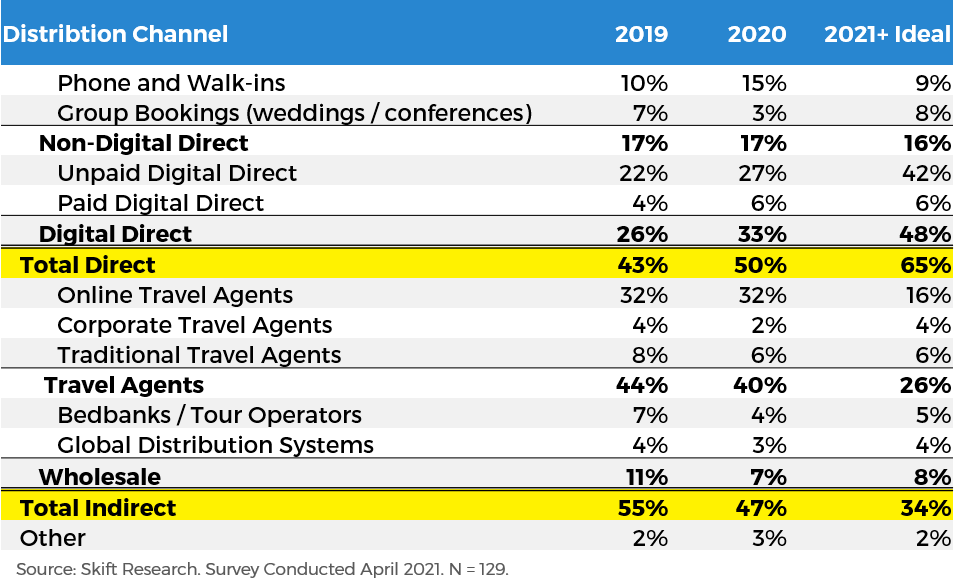

To establish a baseline for comparison, we asked hoteliers to tell us what their distribution mixes looked like in 2019 which could act as a normalized year before COVID-19 struck the industry.

Third Parties Remain A Crucial Part of Hotel Distribution Strategy

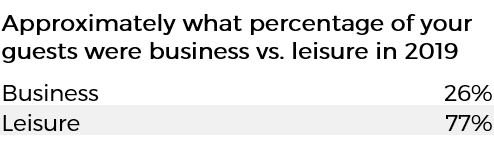

What stands out is the heavy reliance of the industry on third-party bookings. Despite years of hoteliers pushing direct booking initiatives, more than half of sales still come from indirect channels.

The largest single source of bookings in aggregate were online travel agencies, accounting for a third of sales. Travel agents as a whole, including corporate agents and traditional offline agents, accounted for 44% of aggregate bookings. This is just as many sales as the overall hotel direct channel delivered.

Within the direct channel, digital direct was unsurprisingly the largest source of sales, driving nearly a quarter of aggregate bookings. The majority of this was unpaid direct bookings made via websites and mobile apps. 4% of overall bookings came by way of paid digital channels like metasearch or Google and Facebook ads.

Wholesalers, and offline group sales and walk-ins also account for smaller, but still notable chunks of business. And these channels contribute far more than the aggregates would suggest at certain properties that cater more towards specific kinds of travelers.

Direct Booking’s Evolution from 2017 – 2019

Skift Research conducted a similar survey in 2017 for its previous report. We can compare the two to see how the hotel industry had been evolving prior to COVID-19. What immediately stands out is that the direct channel actually fell in aggregate as a source of bookings. This comes as a shock given that the period from 2017-2019 was characterized by hoteliers aggressively pushing direct bookings and investing in the tech infrastructure to support that sales process.

Looking a bit closer into the numbers, we can start to see some nuance and perhaps understand what appears to have happened. The many highly touted direct initiatives primarily drove guests to book online. And these seem to have worked as intended, with unpaid digital direct seeing the largest share increase of any single distribution channel, up eight percentage points to 22% of bookings in 2019 from 15% in 2017.

However, this substantial increase in unpaid digital direct was offset by declines in other, primarily non-digital, channels leading to the overall rise in indirect bookings.

It is also notable that hotelier reliance on paid digital advertising channels declined by four percentage points. In previous research we have discussed how online travel agencies dominate bidding on Google and other travel metasearch sites. For instance, the Expedia Group and Booking Holdings regularly represent 75%+ of all business done by Trivago.

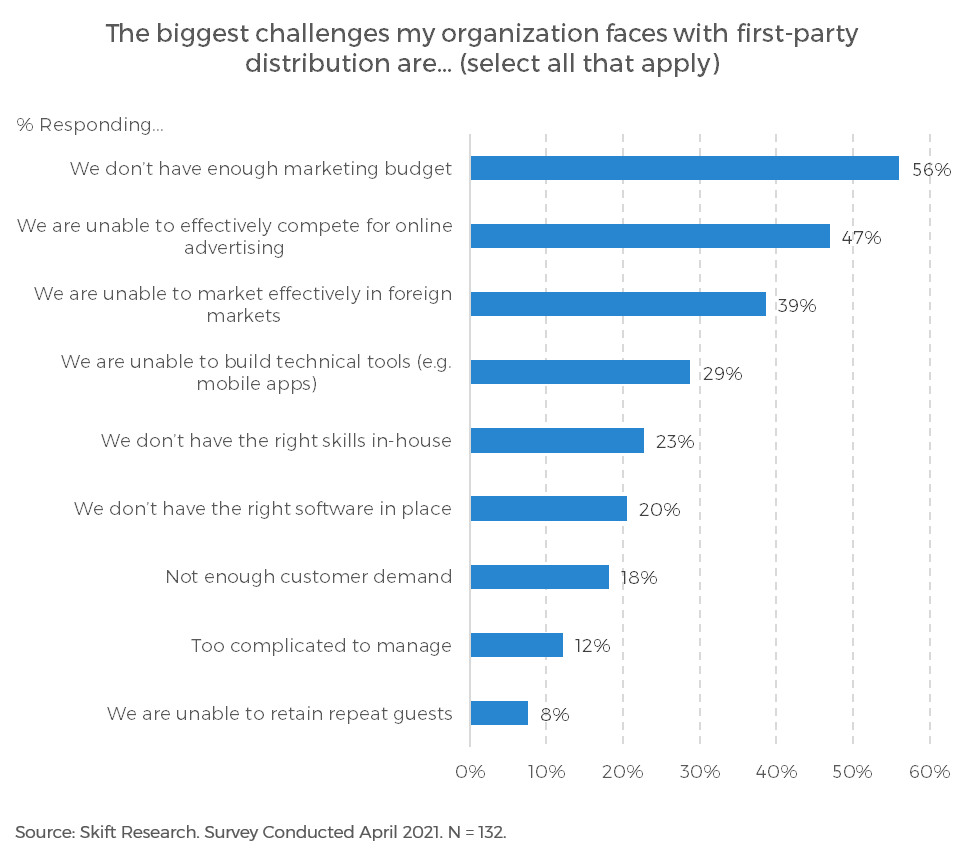

This leads to a “crowding out” effect that makes it hard for hoteliers, which necessarily always have smaller marketing budgets, to win online ad auctions at affordable prices. This in turn either bars hoteliers from participating or means that they generally receive poor returns on investments via performance marketing. In fact, 47% of hoteliers we surveyed said that they face challenges in effectively competing for online advertising against online booking sites and other industry players. This was the second most common first-party distribution challenge faced by all hoteliers surveyed.

While paid digital’s booking share fell four points, online travel agencies rose by six points. It would seem then for all intents and purposes these shifts offset each other and many hoteliers effectively outsourced their online advertising budgets to the OTAs.

Finally, we note that two categories that are often predicted to disappear – traditional travel agents and wholesalers including GDSs and bedbanks – both managed to maintain their booking share. Reports of these businesses’ demise continue to be exaggerated.

Brands vs. Independents

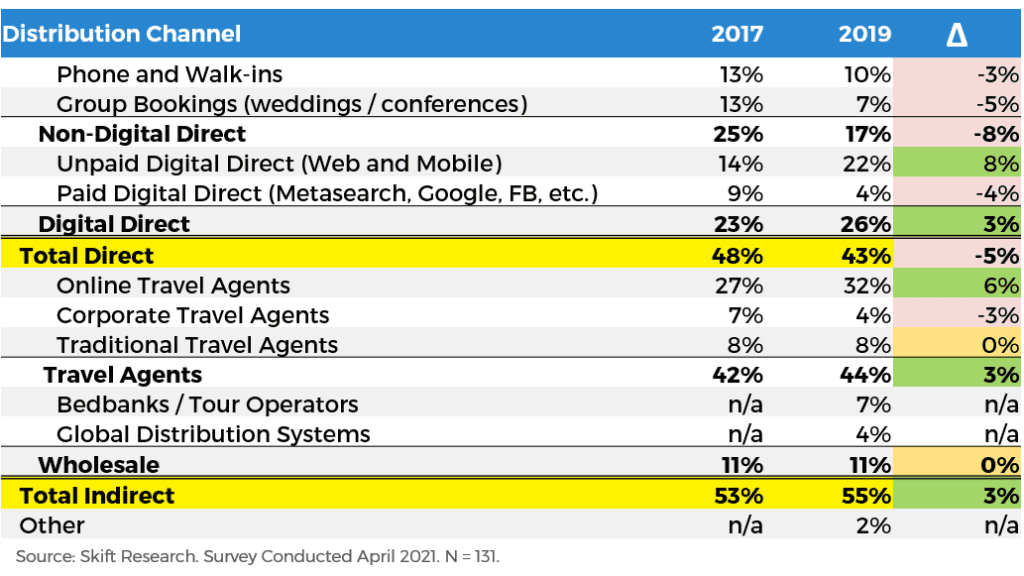

These booking shares are aggregate numbers from our 132 respondents across the travel industry but of course there will be differences at different types of properties. One of the most pertinent factors when marketing a hotel is whether the property is affiliated with a large brand or not. To take a look into how these different dynamics played out in hotel distribution, we subdivided our booking channel data along these lines.

Branded hotels generate a 6-point higher share of sales from direct bookings than their independent peers do. Digging deeper, non-digital direct share is about equivalent. The key difference is the unpaid digital direct channel which clocks in at a 22% booking share for brands vs. 16% for independents. This is almost certainly a function of the loyalty programs that many brands have invested in over the course of years and even decades. It also likely reflects back-end tech lift supporting the booking engines that drive many branded web and mobile sales. This is a striking endorsement of the branded model which appears to be delivering on its value proposition. Brands and franchises are able to drive returns to hotel owners through name recognition, loyalty programs, and IT infrastructure. This helps explain the ongoing shift towards branded hotels worldwide, and is driving the growth in soft brands as well as new distributor-led experiments in branding.

What’s going on with travel agencies here? Branded hotels get 45% of their bookings from travel agents versus 39% at independents. How can branded properties have both a higher share direct booking and a higher share of travel agency bookings vs. independents?

The answer is wholesalers which in our data make up a full fifth of aggregate independent hotel bookings but just seven percent of branded sales. However, this dramatic 13 point differential makes sense as many independent properties tend to be more leisure focused and more heavily located in resort destinations where bedbanks thrive. While brands do of course exist in leisure markets, these properties are diluted by an overall bigger presence in cities and as a business travel customer base (which, again, is attracted by larger loyalty programs).

It’s worth pausing to explore the OTA-brand relationship here. We often take it as a given that independents are the lifeblood of online travel agencies. Afterall the booking sites exist to serve the long-tail and they can charge smaller properties higher commissions. But this research gives some reason to question that assumption.

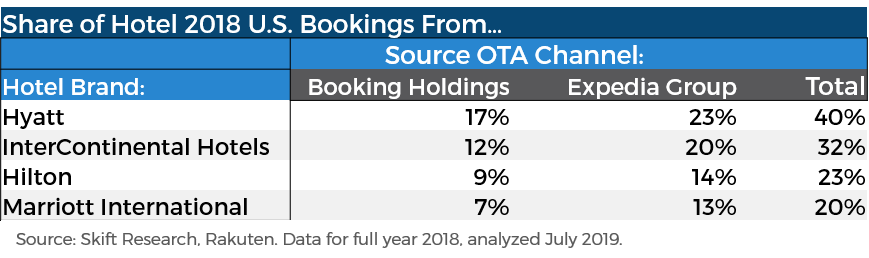

Our data says that in fact branded properties receive 34% of bookings from OTAs vs. just 25% for independents. This suggests that brands are far more reliant on the OTA channel than many might have guessed. 2018 U.S. booking data from Rakuten analyzed by Skift also seems to support this. We found that perhaps as much as 20% of Marriott’s 2018 U.S. bookings may have come from Booking Holdings or Expedia Group owned sites. And Marriott has one of the strongest loyalty programs – and therefore direct booking programs – in the world. At Hyatt, which has a much smaller and younger loyalty program, as much as 40% of U.S. bookings may have been from the world’s two largest OTAs. This data, while surprising, actually ties out quite nicely with our booking channel survey results presented below.

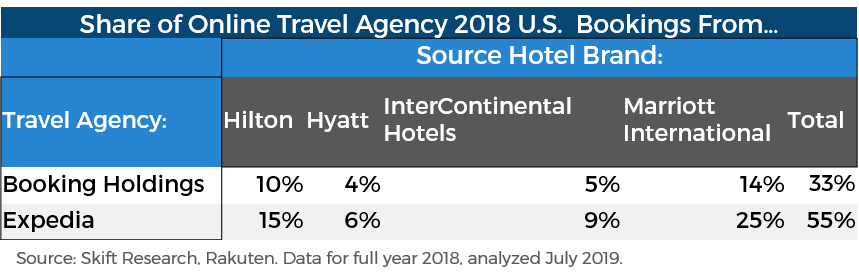

Similarly, our analysis of the Rakuten data suggests that a large part of online travel agency bookings are from brands and not independents. When four large branded hotel chains (Hilton, Hyatt, IHG, Marriott) are aggregated we believe they could have accounted for a third of Booking Holding’s 2018 U.S. bookings and 55% of Expedia Group’s.

Now this is just top-line gross bookings and not representative of profit contributions since commission charges vary widely (e.g. we believe that Marriott pays Expedia high-single digit or low-double digit commissions whereas an independent may pay up to 30%). But even so the profit differences may be even less than previously believed, which we discuss later on.

Overall, the level of interdependence between franchised hospitality companies and online travel agencies is high and likely underestimated. Conversely, Independent hotel reliance on OTAs may be overstated and instead their relationships with bedbanks, tour operators, and global distribution systems are going underappreciated.

What About Alternative Accommodations?

Since we last conducted this survey in 2017, alternative accommodations emerged on the hospitality scene in a big way. We included them in our study and while the sample size is too small to make any industry-wide sweeping conclusions, the data is still worth studying.

Alternative accommodations stand out for their highly concentrated distribution strategies – there are effectively just two channels: direct digital and online travel agency. This reflects the fact that the market has been largely led by digital first platforms like Airbnb, Vrbo, and Booking.com. As an unsurprising result, OTAs account for 42% of industry bookings, a significantly greater share than what we see at any traditional hotel.

Website direct traffic is also much greater than any traditional hotels, while the offline component is just half of what a typical hotel sees. However, this may just be a quirk of our survey sample which is skewed towards digital-first short-term rental startups as opposed to the older generation of mom & pop property managers which are more likely to take a booking over the phone.

Metasearch and paid ad share is about the same as traditional hotels. The market is after all large enough to support dedicated metasearch, and Google recently launched a dedicated short-term rental vertical search module.One of our main takeaways from alternative accommodation’s distribution is just how young the market still is. For instance, the wholesale channel is non-existent for all intents and purposes. Yet we could easily imagine vacation rentals being included on a packaged tour as an interesting way to differentiate an operator in a crowded market. Or the corporate travel market, which while growing is still small in alternative accommodations compared with traditional hotels. There is likely a market opportunity for bedbanks and others to expand here.

Costs and Commissions

Distribution is not just a volume game. All channels also come with a cost of distribution. Sometimes it is an obvious and easily trackable charge as is the case with commissions. But even non-commissionable channels have a cost. Direct bookings may be ‘free’ in that there is no middleman to pay, but they can still be quite expensive with costs such as developing and maintaining a booking engine, or the marketing required to drive guests to your site.

This means the traditional hotel KPI of gross revenue per available room (Gross RevPAR) can be misleading since a high-volume, high-cost channel boosts RevPAR more than a low-volume, low-cost channel, even though the latter may drive better profitability. As a result, tracking channel costs, especially the ‘hidden’ costs, is becoming an increasingly important part of hotel revenue management. Understanding the full lifecycle cost of a booking channel – an approach known as Net RevPAR – allows hotel managers to optimize their distribution strategy for maximum profit rather than just maximum gross bookings.

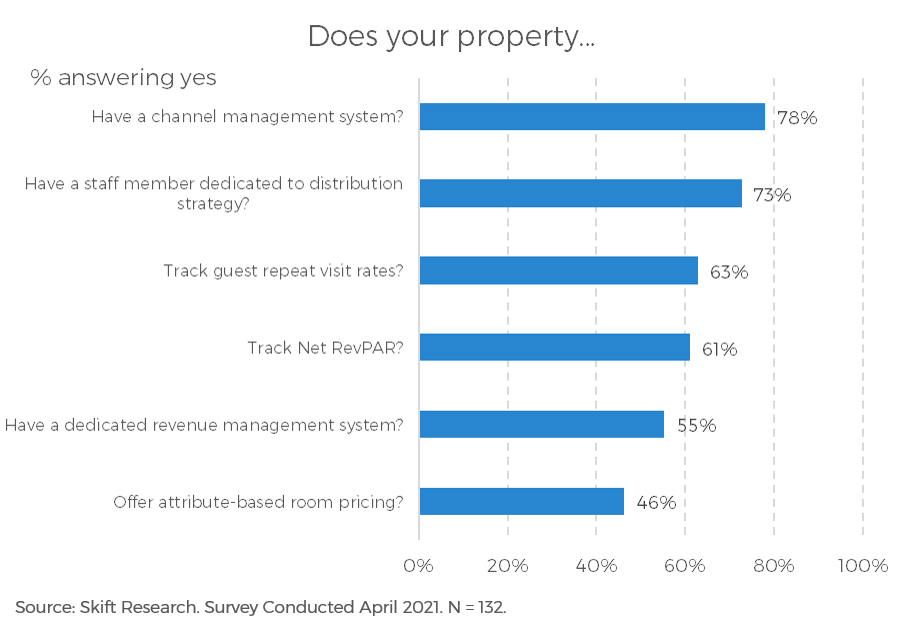

Our survey work indicates that 61% of properties are currently tracking Net RevPAR. While this is the majority of hotels, it suggests the industry still has a way to go in terms of adoption. And by extension there is still significant opportunity for further optimization of distribution mixes across the industry in the future.

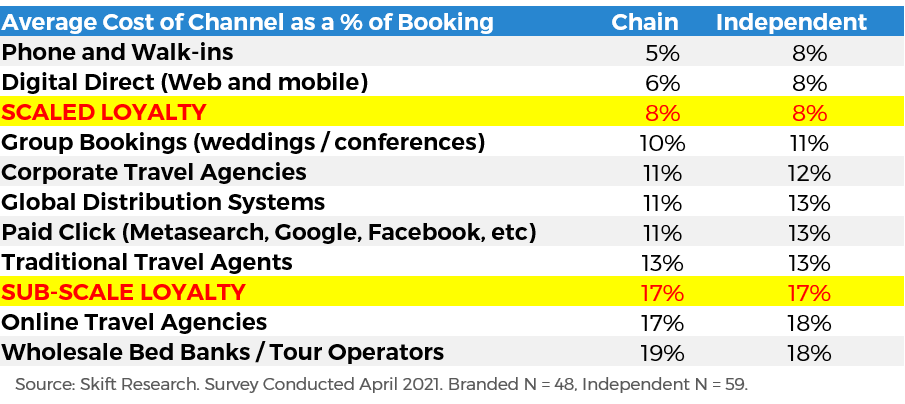

With this in mind, we asked respondents to estimate their average cost per booking across various channels. All costs are expressed as a percent of the booking value and are divided by independent vs branded properties.

The classic direct channels are the cheapest – phone and walk-ins, web and mobile, and group business – it is no wonder they are so highly valued. But it should be emphasized that while cheap, these are still not free and even phone reservations have some cost. But brands do have a cost advantage stemming from scale and infrastructure, both in how phone banks are run and how more modern website conversion funnels work.

The most expensive channels, by far, are online travel agencies and bedbanks, with average commissions approaching 20%. It is interesting to note that, on average, independents pay about the same in OTA commissions as branded properties do. There is a bit of a trick of statistics as the range of fees can vary significantly. We have heard it suggested that Marriott is paying high-single digit to low-double digit commissions to Expedia while on the other hand the highest commission paid by an independent property to an OTA in our survey was an eye popping 45%.

Clearly independents in general have less ability to market themselves globally and brands have more bargaining power against the OTA. As a result, on the margin we expect brands to pay less and independents to pay more. But on average, our survey work suggests that branded vs. independent OTA commissions may be more comparable than previously thought.

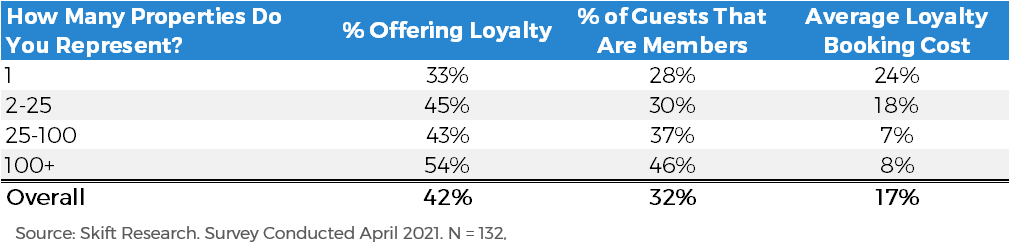

Loyalty Is No Free Lunch

Another common misconception is that loyalty customers are free. After all, loyalty drives repeat customers and direct booking, returning guests are as cheap as they come. But the accounting for loyalty costs is quite complex and can add up to be fairly expensive.

Most loyalty programs are ultimately building up to a free stay which will hit the hotel owner with a reservation that effectively costs 100% of the booking value, far more expensive than any other channel. The opportunity cost of loyalty redemptions must be factored into all of the ‘free’ repeat stays that accumulate those loyalty points in the first place. Plus, large loyalty programs are incredibly complex and require backend software infrastructure, full time staff coordinators, and revolve around expensive marketing campaigns.

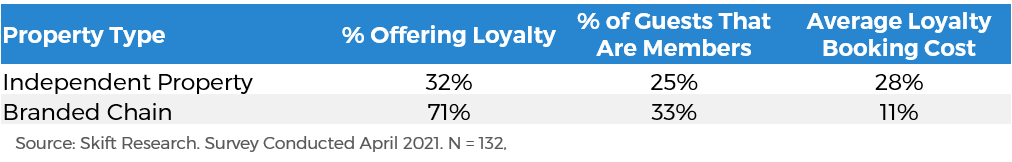

It won’t make sense for every hotel to participate in a loyalty program and of our survey respondents, just 42% said that their companies offered loyalty plans. Of those that did offer loyalty, they reported that typically a third of their guests were members and that the average loyalty booking cost 17%.

Wait, 17%!? That makes a loyalty plan one of the single most expensive ways to drive a booking, just as bad as the online travel agencies. There is some nuance to this figure, however. Our data shows that there is a strong scale and name recognition component to loyalty that makes it a lot cheaper to run a program.

Running a single-property loyalty program is almost prohibitively expensive. But at a 100+ property chain, the average cost of booking is just 8% – that is amongst the cheapest of all channels, almost on par with walk-ins. The breakeven point seems to be at ~25 properties, above which loyalty becomes a no-brainer, but below which it can be costly and cumbersome to maintain efficiently.

We note that the same dichotomy in loyalty booking costs exists between branded and independent properties. This is not a surprise as it is pretty much only large, branded chains that can put together 25+ property loyalty programs. Although some soft-brand collections, online distributors, and third-party loyalty points programs are attempting to do just that.

We’ve recreated our average channel cost chart below to show how loyalty programs fit in. The main point is that loyalty or any form of high guest retention program is no magic bullet. Though repeat customers are a great goal to seek, they are not exempt from our net RevPAR framework. As counterintuitive as it may seem, in certain cases it could be cheaper to buy a non-loyal guest room night via Google Adwords rather than have a repeat guest stay via a poorly managed loyalty program.

It remains important to track channel costs and objectively optimize distribution no matter how much of a layup any given strategy may seem to be.

The Impact of COVID-19

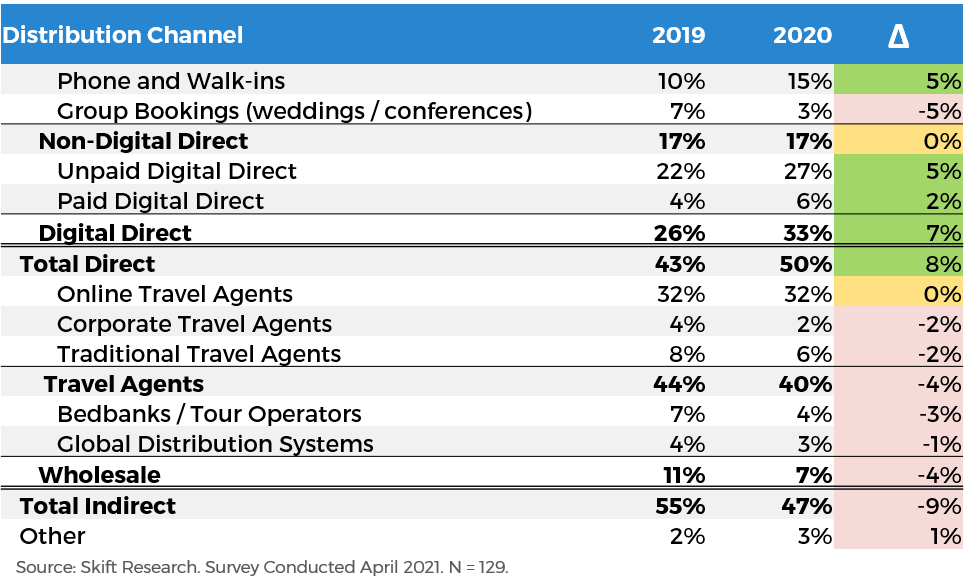

We analyzed 2019 distribution as a baseline for all future comparison, but naturally a lot has changed over the last year. We also asked hoteliers to share how their distribution changed during the pandemic.

What we found is that while volumes may have been severely depressed, the pandemic actually drove quite a favorable change in distribution mix. In aggregate, hoteliers saw an eight-percentage point gain in direct booking share. In effect, COVID-19 did what years of direct booking campaigns failed to do and pushed the average hotel’s distribution mix to majority direct channels.

The two biggest gainers were phone and walk-ins as well as unpaid digital direct. This speaks directly to the uncertain nature of the pandemic. Location-specific travel restrictions and even property-level protocols changed too quickly for third parties to keep up and guests had to visit websites or phone the hotel as the most reliable source of up-to-date info.

Interestingly, online travel agencies were the only intermediary to not lose any share. They held steady at a 32% distribution share – still the largest single channel during the pandemic – while every other third-party channel ceded bookings to the direct channel.

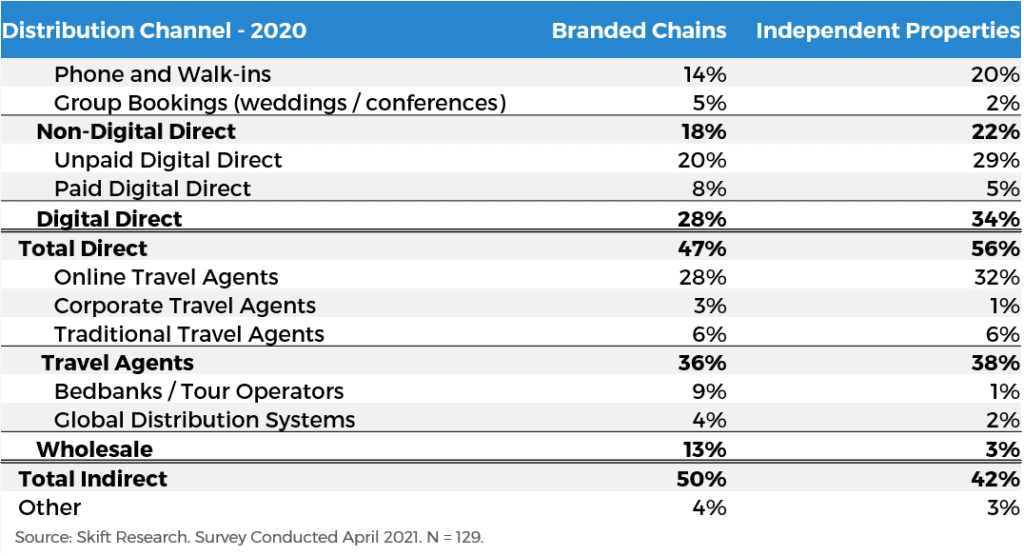

Examining how independent vs. branded properties performed during COVID reveals some interesting patterns and leads us to a counterintuitive conclusion.

In 2020, Independent properties saw a much higher share of bookings from the direct channel than their branded peers – 56% direct vs. 47%. Recall, from our earlier section that in the baseline year of 2019, independents saw weaker direct performance, 39% direct vs. 45%. Branded chains saw a slight bump in direct bookings due to COVID while independents saw a massive 17 point shift.

At first glance, this might seem to suggest that independents outperformed branded properties during the pandemic, but we think that this, counterintuitively, suggests that brands were in a much stronger position.

During COVID-19, the fastest growing channel for independent hotels was phone and walk-ins. It grew eight points to be the third largest booking channel, representing a fifth of all pandemic sales. But let’s face it, phone reservations should not be a growth channel; millennials don’t like to pick up the phone. In this case, the rapid shift towards phone calls represents widespread confusion amongst customers.

Worse, that phone reservations rose much more sharply at independents vs. brands also suggests to us that it was not general travel anxiety but property-specific questions that prospective guests could not get answered online. Ironically, brands retaining third-party sales during the pandemic speaks to us of the strength of their brands. We think a possible explanation for this data is that customers knew and trusted in the branded product well enough to be comfortable booking through travel agents without needing to call or visit the website directly to confirm the information themselves.

We don’t see the sharp rise in phone and walk-in reservations as a pure strength, but rather a challenging opportunity. There is no doubt that the phone and walk-in channel will shrink in 2021, so the question is now how to retain those guests and shift them into digital direct channels.

Regardless of how a property is managed or marketed, all saw a direct booking bump during the pandemic. The key challenge for hoteliers today is how to retain those customers and continue to drive direct bookings at this level in 2021 and beyond.

Looking Forward

There has been one silver-lining to the COVID-19 pandemic, a chance to totally reset businesses and the opportunity to pioneer a new way forward for the industry. What could the future of hospitality distribution look like?

Hoteliers’ Ideal

We asked our audience of hospitality operators to tell us what their ideal distribution channel mix would look like.

No surprises here – the overwhelming desire was for more direct bookings. Hoteliers told us that ideally, their largest channel would be direct web and mobile bookings which they hoped could account for 42% of overall sales.

The gains in the direct digital channel in this scenario came almost entirely at the expense of online travel agencies. Interestingly, the OTAs were the primary target of these hotel operators’ ire. They seemed, in aggregate, to be happy with the level of bookings they receive and pay for from every other third-party provider even though some of these channels are just as expensive as OTAs.

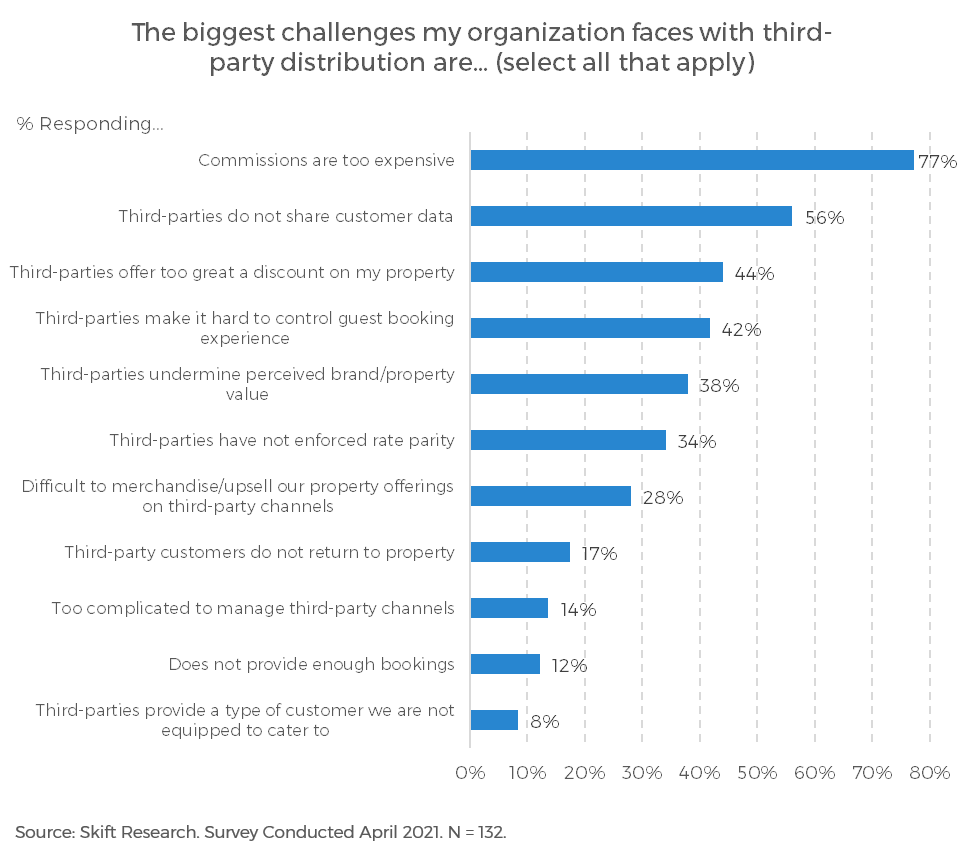

The OTAs were likely singled out because they compete directly for the same type of discretionary leisure customer that most hotels want to capture directly. In contrast, wholesalers don’t go B2C, and corporate and traditional travel agents specialize in higher-value guests that most hotels are not equipped to directly target. Our survey work also indicates long-simmering frustration over OTAs’ data sharing practices, with 56% of respondents citing it as an issue. Third parties not sharing customer data was the second most common complaint that hoteliers had about their distributors, behind only commission costs.

But online travel agencies will be difficult to disintermediate as much as hoteliers may wish it, and this is perhaps not a realistic ideal. Nonetheless, it does speak loud and clear about hoteliers’ intentions, who have thrown down the gauntlet for the online travel agencies to respond.

Hoteliers’ Predictions

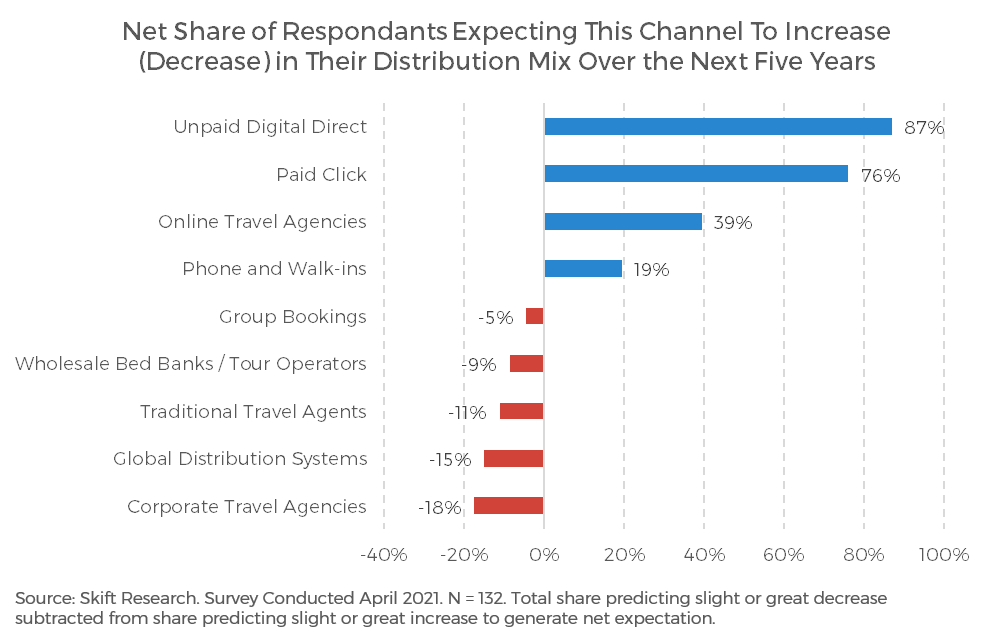

We also asked hotel operators to predict which distribution channels they think will grow or shrink within their businesses over the next five years. This gives us what is perhaps a more realistic view into how hoteliers expect their distribution to evolve over the coming business cycle.

Consistent with their ideal distribution mix, hoteliers expect to see large growth in digital direct channels. This includes both first-party web and mobile bookings as well as paid digital advertising channels. This is good news for booking engine tech providers and metasearch sites like Google and Tripadvisor.

Corporate travel agencies and global distribution systems are the most widely expected channels to see structural declines over the next five years. As both are corporate specialists, this is a pessimistic view on the potential for business travel to return as strong as it once was.

Interestingly, online travel agencies are overwhelmingly expected to grow as a channel as well. This is a tacit admission that hoteliers’ hope for fewer OTA bookings may be a bit of a pipe dream. The online travel agencies have grown rapidly over the last two decades for a reason. They clearly offer value to consumers and are savvy internet marketers. Despite their high fee structures and lack of transparency, we don’t expect them to be replaced any time soon.

Challenges and Recommendations for Driving Direct Bookings

A clear goal as the industry rebuilds from COVID-19 is to drive direct bookings. The overwhelming reason is cost. But as our survey work indicates, there are myriad other reasons for this as well. They include lack of data sharing, undermining brand positioning through discounting, and bad guest booking experiences coming from indirect channels.

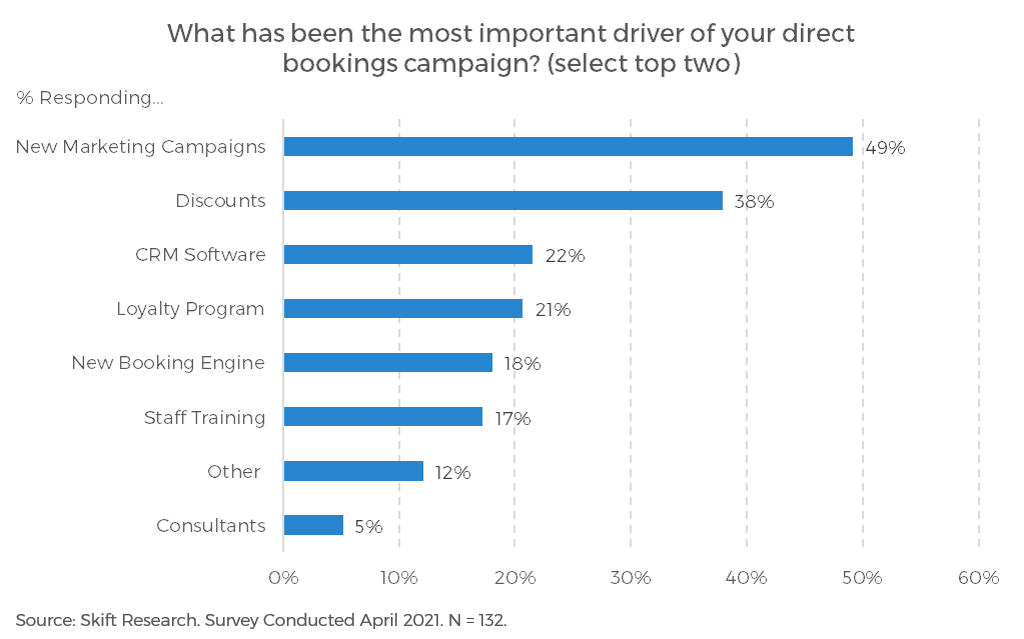

These are all valid reasons to want more first-party bookings and, of course, nothing new. Over the last five years, 88% of hotels we surveyed had launched some form of direct booking initiative. But it’s worth exploring exactly what that means.

Overwhelmingly, the primary way that hotels try to drive direct bookings are by launching new marketing campaigns and offering discounts. It’s a bit ironic because if the top third-party complaints are about costs and the impact of discounting, well, running expensive new marketing campaigns and offering discounts won’t solve those issues.

Accordingly, when hoteliers told us their biggest first-party marketing challenges, the top issues all boiled down to cost-prohibitiveness. We discussed earlier how most hotels simply can’t match the scale of online travel agencies and other aggregators in online ad auctions.

This approach to building direct bookings explains, in our view, how third-party bookings continue to represent a majority of hotel sales despite the overwhelming desire of hoteliers to the contrary. The only way out of this cycle of constrained marketing budgets and challenging online advertising ROI is to build to such a scale that a brand can reach ‘escape velocity.’

At a very large scale, pooled marketing budgets begin to match third-party dollar spend and loyalty programs become a powerful flywheel. But there are only three hotel brands in the world with more than 100 million loyalty members and just five with more than 50 million members. What is everyone else to do?

Best Practices

We are not suggesting that hotels stop marketing or that they never offer a discount again. But we believe the future of hospitality distribution lies in complementing these traditional tools with a systems and operations approach underpinned by a modern technology stack.

We recommend six best practices to supplement existing efforts to drive efficient distribution strategies:

- Use a channel management and customer relationship management system: 100% first-party distribution is still a pipedream and there are many cases where a third-party channel can be a more cost-efficient way of acquiring a guest. Software tools are the best way to manage today’s complex multi-channel distribution environment.

- Have a staff member dedicated to distribution strategy: If distribution is everybody’s responsibility, then it is no one’s responsibility. A dedicated staffer for distribution assures that someone is always paying attention to the properties channel mix and constantly working to optimize strategy.

- Track guest repeat visit rates: Repeat customers are just about as cheap a booking as they come. It is also possible that you are ‘overpaying’ to acquire a pre-existing customer who was likely to return on their own. It’s critical to understand who is returning to your property and why.

- Track Net RevPAR: There is no such thing as a truly free booking. If you are not tracking Net RevPAR, you don’t understand the true contribution of each channel and therefore cannot be making the most efficient possible first- vs. third-party distribution strategy decisions.

- Have a dedicated revenue management system: Pricing goes hand-in-hand with distribution. A good RMS will allow you to maximize bookings via any channel based on timing and demand. It also helps you decide things like optimal times and channels to offer discounts or take price increases.

- Offer attribute-based room pricing: One of the biggest benefits of distributing rooms first-party is the ability to offer attribute-based pricing and to sell guests on ancillaries. Upselling via the first-party channel also drives down the effective cost of acquisition as a share of guest value. This model was pioneered in the airline industry to great success.

Some of these best practices have already been widely implemented. We were pleased to see that most properties already use a channel management system and have a staff member dedicated to distribution strategy. Other practices, like tracking net RevPAR or using revenue management systems are less widespread but still adopted by more than half of all hotels.

Our final recommendation, however, has seen the lowest amount of uptake. We believe that attribute-based pricing has a lot of untapped potential to drive first-party sales and optimize revenue across channels. While still early days for the hotel industry, this model was pioneered in the airline industry to great success.

Conclusion

- Years of direct booking initiatives have slowly moved the needle, but the hotel industry still generates the majority of its bookings through intermediaries.

- Online travel agencies are the largest single distribution channel for most properties. They are unlikely to shrink anytime soon despite persistent hotel owner grumbling.

- Brands do a better job of driving direct booking, putting structural pressure on independent operators.

- Loyalty programs can be a major competitive advantage for large brands but work best at scale and are expensive to maintain. A poorly implemented loyalty offering can wind up being more expensive than an OTA.

- COVID-19 drove a major shift towards first-party bookings. However, many of these direct sales were due to guest confusion, which is a poor selling strategy and an unsustainable trend.

- Hoteliers will have to innovate their distribution strategy in the wake of COVID-19 to sustain the direct booking momentum they saw in 2019.

- We recommend six best practices for hoteliers to optimize their distribution and revenue strategy in 2021 and beyond: use a channel management system, have a staff member dedicated to distribution strategy, track guest repeat visit rates, track net RevPAR, have a dedicated revenue management system, and consider attribute-based room pricing.

Appendix: Respondent Demographics